Reverse cap rate calculator

Expected interest rate EIR The expected interest rate or EIR is used mainly for calculation purposes to determine how much a reverse mortgage borrower qualifies for based on the value of the home up to the maximum lending limit. This cap says how much the interest rate can increase the first time it adjusts after the fixed-rate period expires.

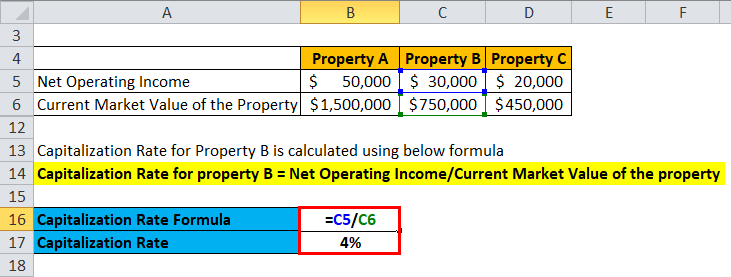

Capitalization Rate Formula Calculator Excel Template

Some lenders may carry this amount over to the.

. The APY Calculator is a tool that enables you to calculate the actual interest earned on an investment over a year. Real Risk-Free Rate 1 Nominal Rf Rate 1 Inflation Rate As such the nominal risk-free rate refers to the yield on a risk-free asset with out the effect of inflation. Since both debt and equity providers are represented in WACC the free cash flow to firm FCFF which belongs to both debt and equity capital providers is discounted using the WACC.

13 2022 to adjust for inflation and calculate the cumulative inflation rate through August 2022. Let us take an example of a piece of machinery used to produce toys that have been leased for five years with a lease rate factor of 0008. Bankrates refinance calculator is an easy-to-use tool that helps estimate how much you could save by refinancing.

For adjustable-rate reverse mortgages the IIR can change with program limits up to a lifetime interest rate cap. Reflects expected inflation the discount rate used should also be nominal. Similarly an interest rate floor is a derivative contract in which the buyer receives payments at.

The credit line option. Todays Reverse Mortgage Rates. Learn how this calculator worksThe US Inflation Calculator uses the latest US government CPI data published on Sept.

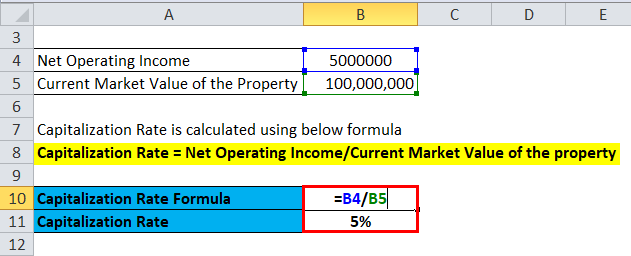

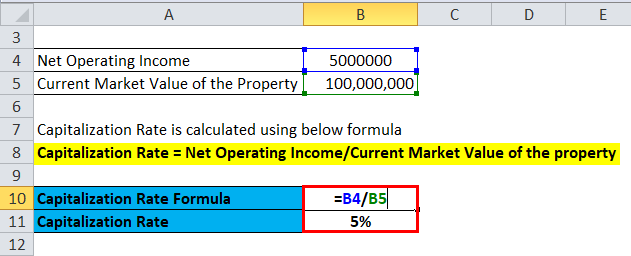

Interest rates are subject to change without notice. It means considering the annual interest rate in the market as 5. You can also use it in reverse.

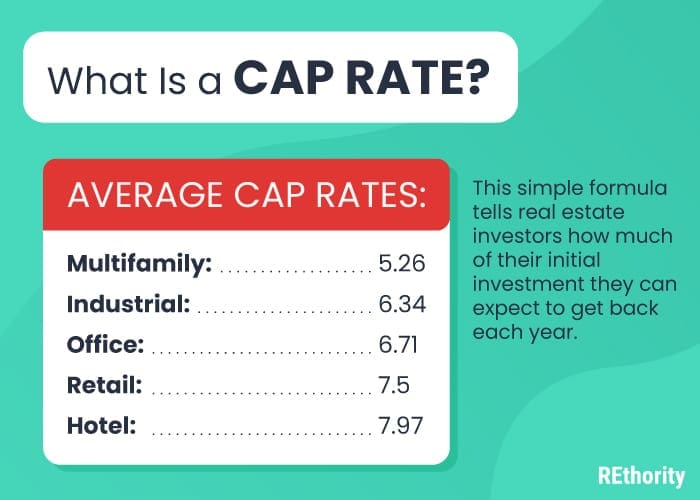

Mortgage rates valid as of 12 Sep 2022 0248 pm. In 2021 the reverse mortgage line of credit continues to be the most popular option for homeowners when choosing how to access their funds. The following is a Cap Rate Calculator.

An interest rate cap is a type of interest rate derivative in which the buyer receives payments at the end of each period in which the interest rate exceeds the agreed strike priceAn example of a cap would be an agreement to receive a payment for each month the LIBOR rate exceeds 25. Learn how this calculator. Reverse Mortgage Counseling.

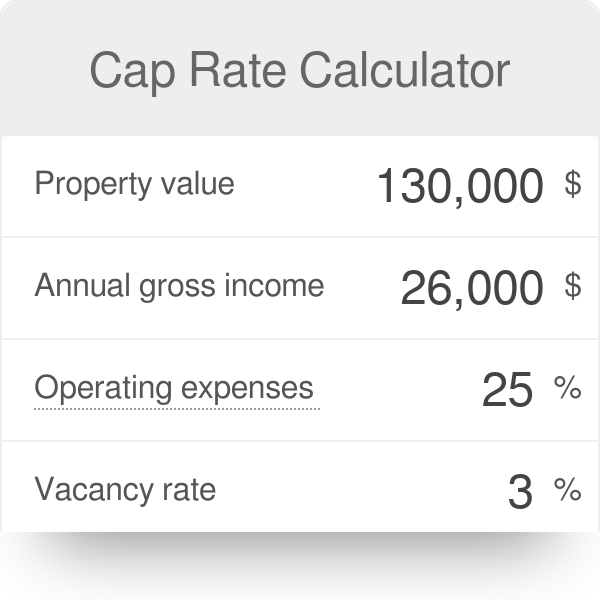

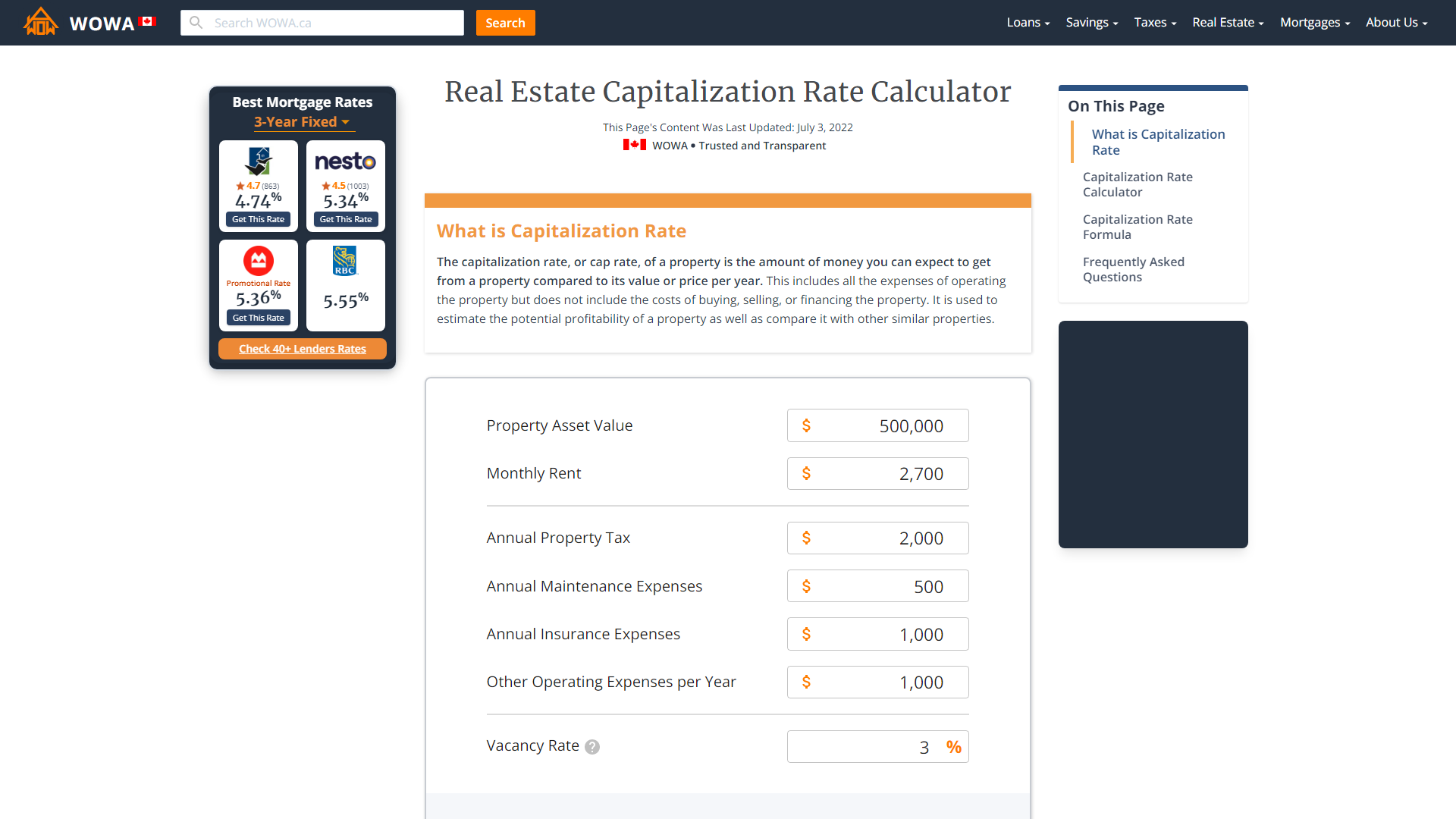

WACC reflects the required rate of return on an investment for all capital providers ie. Our convenient residential income property potential calculator will help you decide what kind of home to invest in as well as show you the full monetary potential of a particular property. It also functions as a reverse cap rate calculator.

Many lenders cap cash-out refinancing at 80 percent of the homes total. Reverse Mortgage Line of Credit. You can find the interest rate with a given.

After the period is over the ownership of the house is transferred to the bank. Reverse mortgage An additional source of income for senior citizens. Labor Departments Bureau of Labor Statistics will release the Consumer Price Index CPI with inflation data for September on.

The factor has been calculated by dividing the interest rate by the number of years the lease is concerned. According to an article by AARP borrowers recognized this choice at about 66 of the time when obtaining a reverse mortgage as being the right choice for them. Annual interest yield APY is a measurement that can be used to check which deposit account is the most profitable or whether an investment will yield a good return.

There are three kinds of caps. You enter a propertys current market value and its NOI into the capitalization rate calculator to get cap rate. Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher.

Under reverse mortgage house that the senior citizen owns is mortgaged with a bank which pays a predetermined amount over the period of the mortgage. From 2002 to 2007 investing in rental properties became all the rage for average Americans thanks to easy-breezy financing and small down payment. The maximum amount the loan interest rate is able to increase throughout the duration of the loan.

If the projected cash flows are discounted in nominal terms ie. Reverse Mortgage Calculator. Simply enter a cap rate and NOI and it returns the current market value of the property.

This is typically set to 5 though in some cases it can be 6. Debt and equity holders. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years.

Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance. 5 Over Start Rate. Its common for this cap to be either two or five percent meaning that at the first rate change the new rate cant be more than two or five percentage points higher than the initial rate during the fixed.

Presently the lowest fixed interest rate on a fixed reverse mortgage is 581 681 APR and variable rates are as low as 5495 with a 1875 marginDisclaimer. A portion of a rate move which was not reflected in the fully indexed rate due to a periodic adjustement cap.

Cap Rate Calculator Propertymetrics

Cap Rate Calculator Formula Online Calculator Rethority

Capitalization Rate Formula Calculator Excel Template

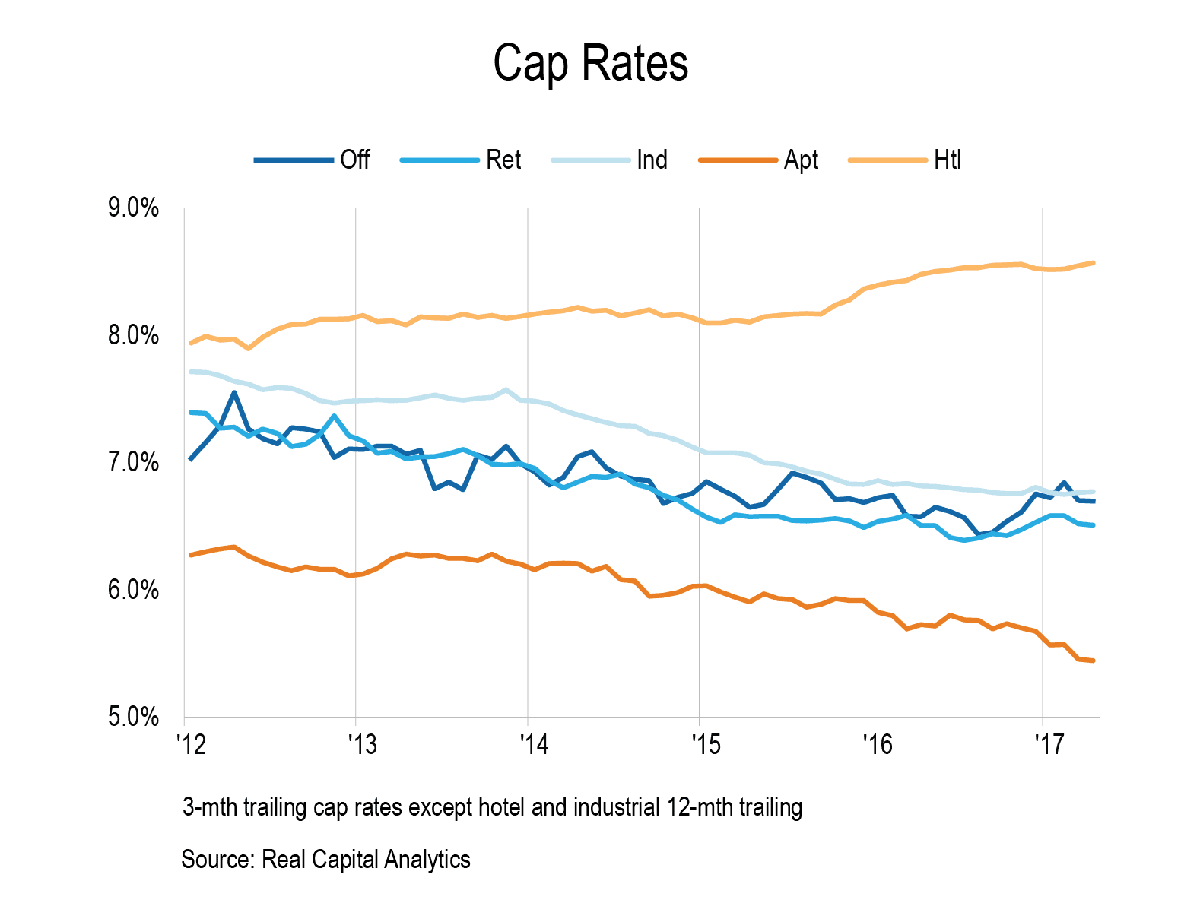

Cap Rate Simplified For Commercial Real Estate Calculator

Cap Rate Calculator

Cap Rate Calculator Free Online Cap Rate Calculation

Capitalization Rate Formula Calculator Excel Template

Cap Rate Calculator

Cap Rate Calculator Formula Online Calculator Rethority

Cap Rate Calculator Formula Online Calculator Rethority

Cap Rate Calculator Formula Online Calculator Rethority

Cap Rate Calculator Propertymetrics

Cap Rate Calculator Formula And Faq 2022 Wowa Ca

Easy Cap Rate Calculator Rentspree Blog

Cap Rate Calculator Formula Online Calculator Rethority

Cap Rate Calculator Propertymetrics

Easy Cap Rate Calculator Rentspree Blog